Our partners cannot pay us to guarantee favorable reviews of their products or services. As owner/operator Joe, along with his team, have guided hundreds of start-ups, structured personal and corporate accounting models, audits, IRS and business conciliation. He credits JCG&A’s growth to personal, hands-on involvement with clients—small and large. Our complete line of tax relief products owner operator bookkeeping allows owner-operators flexibly to get caught up on back taxes and stay on track with the IRS in the future. Our RumbleStrip Essentials product is best for owner-operators who are no strangers to the trucking industry but are looking for efficient and convenient back-office solutions. No matter where you are in your driving career, we have a service package that will match your needs.

Best Trucking Accounting Software

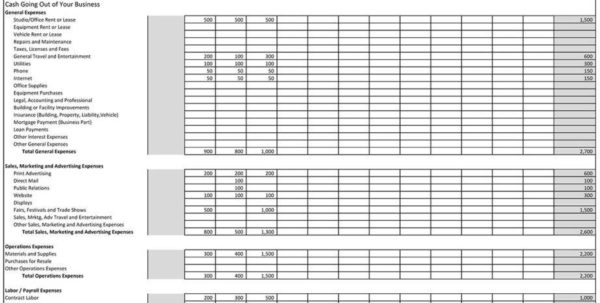

Here are the best tips for managing the bookkeeping for a trucking business. See how much money you’re spending on business, and where you’re spending it. Just click on “expense report” to see all your costs, grouped by categories.

Services for New Motor Carriers

TBS will process your MC#/USDOT Number and BOC-3 for free (both are required to activate your authority), with no annual membership fee or application processing fee. Your out-of-pocket cost will be the $300 Federal Motor Carrier Safety Administration (FMCSA) registration fee and the $50 BOC-3 registration fee which covers the lower 48 states. Let TBS deal with the mountains of paperwork and complicated forms. Our experts will make sure everything is processed correctly the first time, so you won’t have to wait to get those big rig wheels turning. If you’ve been a company driver for a while, you have probably given thought to becoming an owner-op… This is the information I need to manage my business, a clear route to success.

Have More Free Time

My parents have had a trucking business for over 25 years. Rigbooks keeps your data backed up at all times and SSL (https) encryption is standard with all accounts. There’s also no risk of losing your data if your computer crashes. Every aspect of Rigbooks is built to handle trucking bookkeeping, and trucking only. The problem is, you don’t know how much you’ll make until it’s too late. Doing things the old-fashioned way means you’re looking back to find out whether you made any money.

There are always fantastic general ledger and financial reports features when it comes to Quickbooks Online. Other accounting tools include basics like budgeting, billing, invoicing and expense tracking. A common mistake owner-operators make is mixing business and personal finances. Creating a specialized account for business transactions also makes bookkeeping easier in running a trucking business.

What can TruckLogics do for Owner Operators

This just makes it harder for you to figure out how much money you’re really making. It’s easy to slip up when you’re trying to think back to month-old conversations and purchases. So you put them off – but then they just build up until you have no idea whether your costs per mile are even close any more.

- Let us worry about your books so you can focus on running and growing your business.

- FreshBooks is a cloud-based online accounting software solution that provides your company independent owner operator business with a host of features.

- You decide in advance when to charge it, FreshBooks does the calculation and applies the amount for you.

Deposit business checks into your business account, then pay yourself from that account. This makes it much easier to track and separate your business expenses. You want to be able to deduct as many legitimate costs as possible. Keep an envelope in your truck for collecting receipts, or use the dedicated folders on your computer or in a cloud for e-receipts.

However, those in the trucking industry, specifically the truckers themselves, can use Quickbooks’s accounting tools for the business needs of trucking management. We’ve compiled a list of the top platforms that cater specifically to the needs of companies in the trucking industry. In this article, we’ll explore the features, pricing, pros, and cons of the best trucking accounting software options available for companies and individual drivers. So park your rig and read on to find the perfect solution for your trucking business. This best trucking accounting software review gets the full under-the-hood analysis so you know what each piece of software is suitable for. Some of these apps are dedicated to the trucking industry, while others are just good small business accounting software which can be used by truck drivers or companies.

With this information, you’ll be able to tell how your business is performing and if you’re profitable. Is QuickBooks going to help you figure out your IFTA payments? If figuring out your IFTA taxes takes more than 20 minutes, you’re spending too much time on it. With TruckingOffice PRO, we have a specific report that will immediately tell you exactly what you owe. You can make those payments and get on with the business of trucking.

Small-scale businesses are, however, advised to stick to essential software. While these platforms might not be loaded with cutting-edge features, they incorporate crucial elements that make bookkeeping easier. Businesses with a more extensive fleet can employ TMS for better control over operation management. Evidently, owner-operators need to understand bookkeeping for their businesses.